There is something new? exactly the Russian government with P.M Putin did visit the country. A lot of the country was happy about this strong signal and it was a nice proof of trust the Russian head of government the wide way from Moscow to Abkhazia did travel. Not only he gave several milliard roubles (Will be payed after the election) of development aid for the country but he did visit the new natal station (payed by Russia). He met the political élite in the country and brought a security feeling and an impulse that a golden future for many inhabitants of Abkhazia waits. Now completely beside I am ready with my plannings and now would like to introduce my index for Abkhazia. For a long time I wanted to develop with friends and the German Abkhasian association the plan such a kind of index for the country should be created. Now it is ready and should offer You such a kind of basic picture of the Prices of Abkhazia.

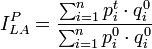

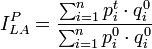

Like a lot in the country it is not like in other countries and it cannot be fallen back on a state instrument. A not representative statistics is also a Information and better than nothing. I strongly do believe it should become only a basic idea, a sort of further information of the country. I have taken the prices at 10 places in the capital, 5 places in Odtshamtshira, 5 places around Novi Afon, 5 places in Gudauta and 5 places in Gagra to make these values so prestigiously as possible. Unfortunately, there is still no real statistics authority, nevertheless an official statistics should be introduced for the future by development aid from the Russian federation. Often I have got the question how expensive is the country how many person do stay in Abkhazia etc... with this formula and other economic news I try to get out with the help of different people, the German Abkhasian association and other aid the first values.

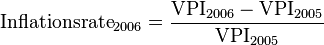

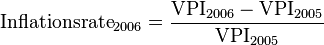

Now more the data Q1Q2Q3Q4Q1 08/09

Now more the data Q1Q2Q3Q4Q1 08/09

Now more the data Q1Q2Q3Q4Q1 08/09

Now more the data Q1Q2Q3Q4Q1 08/09So, now is the Question what we see here?the inflation decreases very strong in the rouble zone, however could we see here the might be start of a deflation?

Of course we should not take the Oil price speculation of the past 12 Month to strong in to account and aslo the data have been collected in last summer during the war which made them also a bit falsified. The crisis economy of Abkhazia looks in to many ways differently than Russia, nevertheless, we could maybe see a bad messanger. A Dark Angel with the Message.. Do we get deflation? The first quarter looks strongly afterwards, if yes so whats about it?

Direct effects First the opposite direct effects of inflation; debtors are disadvantaged, because there material goods financed above loans lose value, but they must still pay the same monetary value settled in the beginning. However, profit believer of a deflation, because there capital get a higher value than at the beginning of the period – interest-adjusted–. The purchasing power of the consumers rises what is benefit therefore first for all. But the deflation is problematic because not all prices are free and are pliable with it. With a steady money supply the productiveness increase would affect directly the prices.

Indirect effects „Classical deflations“ in the form of massive dramatic drop in prices about wide good offers and service offers had happened earlier, e.g., at the moment of the worldwide economic crisis in 1930, once a strong trend towards a certain durability. If a country suffered once from a deflationary phase, the danger or deflationary trend was very big: Sinking prices led to a noticeable purchase restraint of the consumers, because these could count on further sinking prices. The sinking inquiry caused again a lower extent of utilisation of the production capacities and with it further sinking prices. One calls this circulation generally deflation spiral. The fact that, nevertheless, a general deflation (i.e. of classical kind of 1930) could originate even today once, it is held rather unlikely, because as for example inflationary Fiat Money "production" by the central banks can be countersteered through monetary-political measures , however, a renewed „danger of the deflation“. a falling prize level is also already to be observed since the 1990s in Japan.

Causes of deflation Consumption and investment restraint If a national economy is in the recession of an economic situation cycle, the people (normal people) react carefully. They expect that there income situation will get worse, they fear about there job, and, therefore, spend in the expectation of an in future lower income and the position resulting from it of the existence protection less money (consumption strike). An increased increase of the personal financial reserves starts at most when the influx sinks in money for the person not so strongly as the drain in money. Also the enterprises are reserved. Only the most necessary is bought and invested a little (so-called investment restraint). This inquiry decline leads to the fact that enterprises register lower turnovers or also profits, and rationalise in the initial stage (often by mass redundancies) or, finally, in the last authority, become insolvent. Now all together the whole good inquiry sinks with about constant good offer (inquiry gap). Basically lower needs are the cause of consumption restraint. Whether these lower needs from self-control or lacking money result is another thing. A bigger savings inclination can also be a reason, caused by a made worse future expectation. At the moment this phenomenon is to be observed in Japan.

Property deflation, loan deflation Particularly by burstting of speculation bubbles as for example real estate bubbles it comes to a property deflation, above all if the property objects have been financed by loans. Then the sinking property prices lead to the overextension of households by which it comes to loan failures and also the banks get in distress. Because now less new loans are awarded than run out and fall out, the money supply sinks. The consumers can also finance consumption expenses hardly with loans, so that in the national economy the inquiry decreases. Thus the property deflation can release a general deflation. The economist Heiner Flassbeck speaks of "debt deflation", it causes speculation of banks and fund on permanently rising prices of investments and the course value of certain currencies. This bet has broken what is the cause for the fact that feverishly investments are sold and the prices of the same go to ruin collapse-like. Such a spiral exceeds down the so-called "selfhealing forces" of the market.

Wage deflation Because of the positive back coupling of the development of wages and prices (wage price spiral) a deflation or wage deflation leads to a cumulative process in a national economy with which good prices and factor prices fall at the same time. If long-term deflation expectations develop, it is difficult for the central bank extremely to break this by an expansionary monetary policy. This phenomenon is called liquidity case: On account of hardened deflation expectations in the economy even nominal interest of zero offers no incentive for the grant of credit by commercial banks to investors or consumers to percent. The loan risks of the believers towards the potential debtors are looked by the Debitors on account of the general insecurity about the future economic development as a result of the deflation higher than by the grant of credit for the believers to attainable interest proceeds. Then loan rationing by the commercial banks prevents that the potentially available liquidity can be moved by the zero interest rate policy of the central bank in actual inquiry with investors and consumers what would be absolutely possible about rising grant of credit by commercial banks. Only if again trust originates in the economy to a close end of the deflation, resolves the liquidity case in which the monetary policy is, and the normal effect connection produces itself again.

Reduction of the state expenses An other possible reason for deflation is the state sector. If a government shortens the state expenses drastically, possibly to reduce the budget deficit or to achieve a budget profit, the state inquiry at the markets precipitates smaller, and one reached again with constant offer to an inquiry gap.

Foreign-trade causes Also the foreign countries can be a trigger of a deflation-bringing offer profit. First, if the inquiry from abroad slow down because the economic situation is lame (for example, because of a worldwide economic crisis), this also meets own national economy, above all if the export portion is big. Secondly a revaluation of own currency can be a trigger of the deflation. It makes, on the one hand, the exportations for the foreign customers more expensive. If possibly the euro rises compared with the US dollar (revalues, i.e. EUR USD of course rises), the dollar prices of German cars increase in the USA and the inquiry for German cars sinks. At the same time the revaluation of the domestic currency makes import products more favorable. This is reflected directly in the home prize level. Thirdly an offer profit can also originate by home if foreign markets cut themselves off, possibly by duties or other protecting measures. Monetary causes According to monetary image inflation and deflation always and everywhere are a monetary phenomenon (Milton Friedman). The being behind this idea is that a restrictive monetary policy (rise of the least reserve, increase of the interest rate) about the quantity equation lead for lower prices. However, also after not monotery view a restrictive monetary policy leads to deflation, because it damps the overall economic inquiry (for example, by the higher central bank interest). The free-economic theory – by the prevailing majority of the economists is rejected – the cash flow speed sinking after conviction looks as a main cause of the deflation. This "Storrage" originates according to free economy apprenticeship from the fact that an investment whose yield is more slightly than the liquidity premium is not lucrative any more and, therefore, the monetary

offer at the capital market decreases.